OKX Rubix

We’ve Launched Rubix: A Modular Workflow Solution for Regulated Digital-Asset Services

By Simon Ren, SVP, OKX Institutional

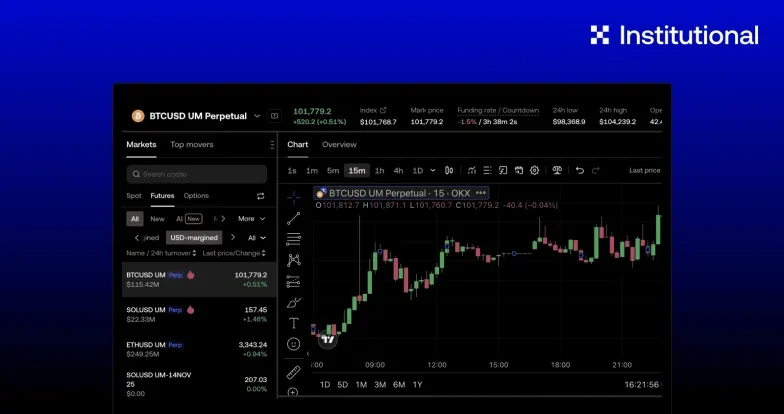

Today I’m pleased to announce the launch of OKX Rubix — a modular workflow solution that enables regulated financial institutions to provide digital-asset services to their clients and customers. Rubix allows institutions to integrate digital assets seamlessly into their existing operations — from market access and execution, to custody, collateral, and reporting — without rebuilding infrastructure or changing their operating model.

Why We Built Rubix

Institutional demand for digital assets continues to grow, but adoption has been slowed by operational complexity, fragmented infrastructure, and evolving regulation. Financial institutions need a regulated, integrated solution that aligns with their governance, risk, and compliance frameworks. Rubix is a modular workflow solution that fits seamlessly into an institution’s front-, middle-, and back-office operating model, assembling market access, execution, custody, settlement, and controls into one coherent framework. You retain your channels, branding, and client relationships; we provide the regulated market infrastructure behind them. By solving the operational puzzle, Rubix lets institutions provide regulated digital-asset services while retaining their own client experience, policies, and governance.

How Institutions Are Using Rubix

With Rubix, financial institutions can embed digital assets directly into their existing platforms, allowing them to diversify into new asset classes and unlock new revenue streams from trading, lending, and asset management.

Banks – Expand retail and wealth offerings by integrating digital asset buy/sell capabilities alongside traditional investments, with streamlined fiat on/off ramps and stablecoin-based settlement.

Brokers – Enable retail, corporate, and institutional clients to access core digital assets such as BTC and ETH directly through existing FX or multi-asset platforms. These assets offer the deepest liquidity and clearest regulatory standing, serving as the entry point for institutional adoption. Over time, brokers can expand to additional regulated tokens and yield products while maintaining full control of client experience, execution, and compliance through Rubix’s modular architecture.

Neobanks – Differentiate by integrating crypto trading, stablecoin payments, and staking directly within digital banking apps — capturing younger, crypto-native customer segments without building exchange infrastructure.

Private & Wealth Banks – Offer clients regulated access to digital assets, including spot exposure and tokenized yield products, through existing discretionary or advisory frameworks, supported by secure custody and transparent compliance alignment.

Building Blocks You Can Compose

Each institution can configure Rubix according to its regulatory footprint, operating model, and control framework:

Regulated market access – MiCA/MiFID II (Europe), VARA (UAE), AFSL/AUSTRAC (Australia), CNV (Argentina), U.S. MSB/MTL.

Liquidity & execution – Deep CLOB markets and OTC RFQ for size and best execution.

Post-trade settlement – “Trade first, settle later” for capital efficiency.

Seamless Connectivity — bespoke integrations with existing OMS/EMS systems, plus FIX, REST and WebSocket APIs.

Off-exchange custody – Integrations with licensed bank custodians and third-party providers.

Collateral optimisation – Trade using fiat, stablecoins, crypto assets, and tokenized money-market funds..

Why Rubix Is Different

Rubix prioritises operating-model fit: it connects directly to OMS and EMS systems, as well as licensed custodians and third-party providers, enabling institutions to integrate digital-asset capabilities within their existing infrastructure, controls, and governance frameworks. As institutional needs evolve, Rubix’s modular architecture will extend to additional integrations across risk management, surveillance, and reporting systems, supporting a fully end-to-end operating environment.

Live Today

Rubix is already operating with institutional partners across Europe, APAC, the UAE, and LATAM, with additional firms progressing through onboarding. If your mandate is to offer, manage, and settle digital assets under your own governance, Rubix is designed to make that possible.

Rubix. Problem solved. Get in touch with the team here.

© 2025 OKX. Anda boleh memproduksi ulang atau mendistribusikan artikel ini secara keseluruhan atau menggunakan kutipan 100 kata atau kurang untuk tujuan nonkomersial. Setiap reproduksi atau distribusi dari seluruh artikel juga harus disertai pernyataan jelas: “Artikel ini © 2025 OKX dan digunakan dengan izin.“ Petikan yang diizinkan harus mengutip nama artikel dan menyertakan atribusi, misalnya “Nama Artikel, [nama penulis jika ada], © 2025 OKX.“ Beberapa konten mungkin dibuat atau dibantu oleh alat kecerdasan buatan (AI). Tidak ada karya turunan atau penggunaan lain dari artikel ini yang diizinkan.